We imagine our greatest asset is our folks. We benefit our commitment to various perspectives along with a tradition of inclusion over the company. Uncover who we are and the appropriate possibility for you personally.

Theoretically, by proudly owning holdings that behave in different ways from each other (in investing lingo, Meaning discovering investments that have low or detrimental correlations with one another) an investor can build a portfolio with risk-modified returns that happen to be remarkable to These of its individual elements.

With the most important retirement savings reform laws of the final 15 many years becoming passed, it’s purely natural to own lingering inquiries. With retirement plans now in get to for both of those the employer and worker, we’ve highlighted the most significant takeaways to concentrate on.

For 89 several years, we’ve had a passion for what’s achievable. We leverage the entire methods of our business that will help individuals, households and establishments reach their financial aims.

Wealth management refers to products and services accessible through the functioning subsidiaries in the Charles Schwab Company, of which there are essential discrepancies, which includes, but not restricted to, the sort of assistance and support furnished, costs charged, and also the legal rights and obligations of your events.

This is certainly especially true if the securities or assets held are certainly not carefully correlated with each other. Mathematically, diversification lowers the portfolio's Over-all risk without sacrificing its predicted return.

"Over-diversification" tends to happen when you can find currently an ideal quantity of securities inside of a portfolio or For anyone Asset protection companies who is incorporating carefully correlated securities.

At Morgan Stanley, we lead with Extraordinary Tips. Throughout all our companies, we offer keen insight on present day most critical problems.

You'll find risks affiliated with any investment tactic, as well as ThomasPartners Strategies have their very own list of risks:

Fidelity does not check my site provide lawful or tax assistance, and the knowledge offered is common in mother nature and shouldn't be regarded lawful or tax advice. Check with a legal professional, tax Expert, or other advisor concerning your certain legal or tax predicament.

We do not offer financial advice, advisory or brokerage services, nor will we suggest or advise individuals or to order or market individual stocks or securities. Performance details may have changed Because the time of publication. Past functionality will not be indicative of foreseeable future results.

Diversification can help investors never to "put all of their eggs Retirement wealth-building services in one basket." The thought is usually that if one inventory, sector, or asset course slumps, others may possibly rise.

1. Unfold the Wealth Equities provide potential for high returns, but Do not put your entire income in a single stock or a single sector. Take into account building your own private Digital mutual fund by investing in A few companies you recognize, have faith in, and in many cases use as part of your day-to-day everyday living.

4. Know When To obtain Out Getting and holding and dollar-Expense averaging are seem strategies. But Because you've got your investments on autopilot does not imply you ought to disregard the forces at perform.

Michael Bower Then & Now!

Michael Bower Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Brandy Then & Now!

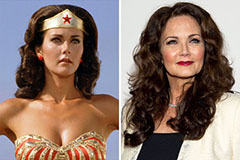

Brandy Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!